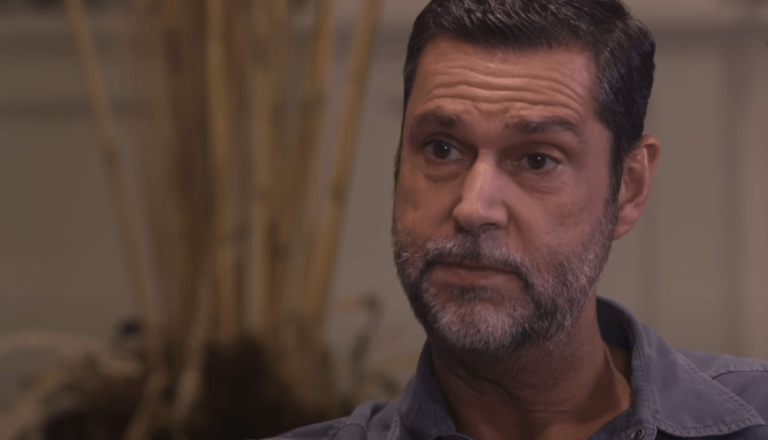

Raoul Pal: Hedge Funds, Family Offices, Institutions, Retail All ‘Underweight’ Crypto

On Sunday (July 31), former Goldman Sachs executive Raoul Pal talked about why he is so excited about the long-term outlook for crypto (and in particular Ethereum).

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

In the April 2020 issue of the GMI newsletter, Pal explained why he believes that Bitcoin, which he called “the future”, could one day have a $10 trillion valuation. In that issue, Pal said that the idea of a $10 trillion valuation for Bitcoin is not so crazy:

“After all, it isn’t just a currency or even a store of value. It is an entire trusted, verified, secure financial and accounting system of digital value that can never be created outside of the cryptographic algorithm… It is nothing short of the future of our entire medium of exchange system, and of money itself and the platform on which it operates.“

Since then, Pal has provided updates on changes to his crypto holdings, and currently seems a lot more bullish on Ethereum than Bitcoin. For example, on 29 October 2021, he tweeted:

Anyway, earlier today, Pal took to Twitter to point out that “most people who have a crypto investment mandate are not fully allocated to crypto as they moved to part cash.”

He went on to say:

- “Above this level, retail will start to be forced in, along with institutions. 2200 to 2300 is the key one for me…a break of that either happens pre-merge or post-merge. Once everyone has got back in, the market can correct sharply before rising again based on the macro.“

- “The macro is key here. Global M2 is the big macro driver of crypto (the liquidity cycle)… And it is about to turn… the ISM (inverted) leads it…I think crypto is sniffing out the turn.“

- “Same with inflation – the other bogeyman. ETH is starting to price in the turn in inflation, which I think is correct. But I cant help but mull over the long term chart of BTC vs the second best performing asset since 2010 – the NDX. The NDX is down 99.9% in relative terms. It is at key resistance too…“

- “But the last 3 years have been all about ETH. That has outperformed the NDX by 90% since then. And that NDX/ETH ratio has put in a DeMark weekly 9-13-9 and suggests a full reversal. ETH should outperform by another 90% over the next few years…“

- “The support should get taken out in due course… ETH is also breaking out versus BTC… This is being driven by the superior current network effects and network activity.“

- “Sure, other tokens will outperform ETH but crypto overall will outperform all other assets, in my view. My hunch is that the market is caught underweight (as it is in equities too) and the path of pain is higher. But, that is just shorter-term thoughts. The long-term is clear.“

On July 3, Pal talked about a new Web3-focused business (ScienceMagic.Studios) he recently co-founded.

ScienceMagic.Studios describes itself as “a digital asset venture studio” that advises and implements “the creation of digital assets (e.g., NFTs and social tokens) and web3 economies for brands, talent and their communities.”

Its three founders are David Pemsell, the former CEO of Guardian Media Group; Kevin Kelly, who is “a co-founder of Delphi Digital, the leading research & consulting firm dedicated to web3 and digital assets, and a partner at Delphi Ventures, the firm’s investment arm”; and Raoul Pal.

As The Block reported on June 14, the firm “raised $10 million in pre-seed funding” from an impressive set of backers that included Coinbase Ventures, Digital Currency Group, and Liberty City Ventures.

On July 3, the Real Vision CEO took to Twitter to explain what his new firm is trying to do:

He went on to say:

- “Our mission is to tokenize the worlds largest cultural communities – music, fashion, movies/book/TV franchises and sports – utilizing NFT’s, social tokens and metaverse to build community, utility and experience.“

- “There are $63trn of intangibles on global balance sheets of corporations. Tokenization turns brand and community into tangibles and shares the utility and network with the community. It is potentially the biggest change in business models in a very very long time.“

- “We’ve been alluding to this for a long time! It is one of the biggest opportunities in Web 3, helping big brands move into Web 3 in the right way – creatively but cautiously and meticulously. We are already in talks with some monumental people/brands. Really, really exciting!“

Source: Read Full Article