We just paid off our credit card. How do we avoid getting into debt again?

Save articles for later

Add articles to your saved list and come back to them any time.

I have three primary school-aged children. My husband works full-time, I work casually, and we’ve just finished paying off all our credit card debt. It’s a relief to have a clean slate for the first time. However, I’m nervous this won’t last long and we’ll end up in debt again soon. I want to start saving more so we can save up for a home deposit, but we struggle to save. We don’t have much left over at the end of the month and any extra money goes into activities for the kids. How can we stay out of debt and start making positive momentum towards our savings goals?

There’s a practical component to this problem and a behavioural one. Let’s start on the behavioural side.

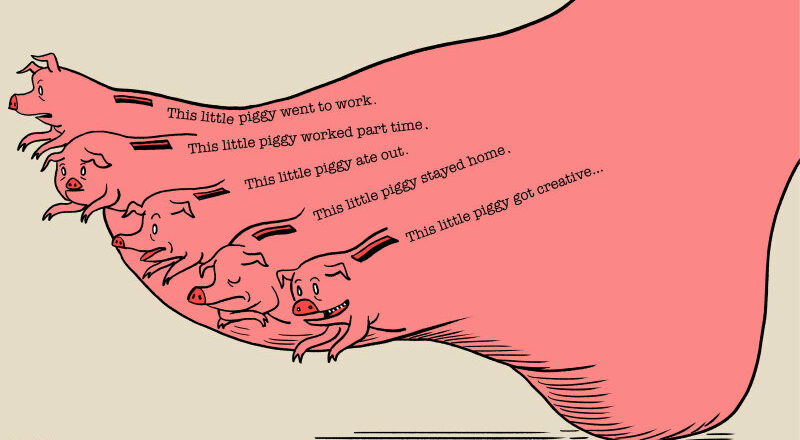

When trying to save money, get as creative as possible in brainstorming alternatives to your current spending.Credit: Simon Letch

An important ingredient to being able to achieve your goals is self-trust. From the sounds of it, you don’t trust that you’ll be able to keep the positive momentum going.

One reason people struggle to build self-trust is because they try to go too big, too fast with their goals. They aim to save thousands before they can confidently save hundreds.

They do this because we’re taught to think big and have big goals. Starting small feels inadequate, mediocre, and even embarrassing.

But often, having excessively big goals that are too far removed from your current reality does more harm than good. It sets you up for failure.

When your goals are too big, small wins don’t feel big or fast enough. Saving $50 when your goal is $20 feels like a win. But saving $50 when your goal is a house deposit feels inadequate.

So you end up feeling constantly frustrated. You wonder why it’s not working, why you’re not making progress faster. Eventually, you may just get demoralised and give up.

If you want to continue the positive momentum, start small. Start by building confidence in your ability to stay debt-free by relying on your income for a few months. Then, move on to building confidence in your ability to save a small amount consistently. Build slowly from there.

While this will feel painfully slow, remember that slow but consistent progress is better than trying to rush one step ahead only to end up two steps back.

Get as creative as possible in brainstorming alternatives to your current spending.

On the practical side of things, there are two main ways to create more space in your budget: reduce your expenses and increase your income.

The first thing that’s not clear is how much visibility you have on your expenses. Do you know how much money you spend, and where the money goes? If not, this is the first place to start.

So, print out all your bank statements and categorise all your expenses into 10-15 different categories (e.g. groceries, eating out, clothing etc). Then look for the three Ds: what can you delete, downgrade, or get a deal on?

Also, get as creative as possible in brainstorming alternatives to your current spending.

Money is the most convenient exchange you can make to get goods and services. The more you’re willing to inconvenience yourself, the more savings opportunities you will find.

For example, you can buy food, or you can save money if you’re willing to cook. Car ownership is convenient, but you can also walk, or ride a bike, or rent your car out when you aren’t using it.

So, there’s a tradeoff between money and convenience and the right balance is personal. But if you engage in the brainstorming process, you might open yourself up to new opportunities.

This first step of optimising your expenses will also give you clarity on exactly how much more money you might need to achieve your goals.

This brings us to the second part of this process. There is a limit to how much you can cut spending. After a point, if you want to fast-track your progress, you need to increase your income.

You could increase your work shifts, or move into part-time work. Alternatively, you or your husband could find higher-paying jobs. Those are the obvious solutions.

You could also consider opportunities outside your main employment. Today, the ways in which you can earn money are more numerous and accessible than any other time in human history.

These days, people receive this suggestion with mixed reactions. “I already work hard enough.” “Hustle culture is leading to burnout.”

I’m not advocating for working at the expense of your well-being. Nor am I saying you have to have a side hustle. If your household brings in enough from your primary profession, great.

But if you want more money, then a side hustle can be a fantastic option. Now, finding the correct one to fit your lifestyle and personality takes some trial and error. But if you stick it out, you might discover more income security than a single job could ever have given you.

- Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. They should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.

Paridhi Jain is the founder of SkilledSmart, which helps adults learn to manage, save and invest their money through financial education courses and classes

Most Viewed in Money

From our partners

Source: Read Full Article