US 'slowing towards a recession,' if it's not already in one, former Kansas City Fed president warns

Can the Fed attain a soft landing as the central bank tries to curb red-hot inflation?

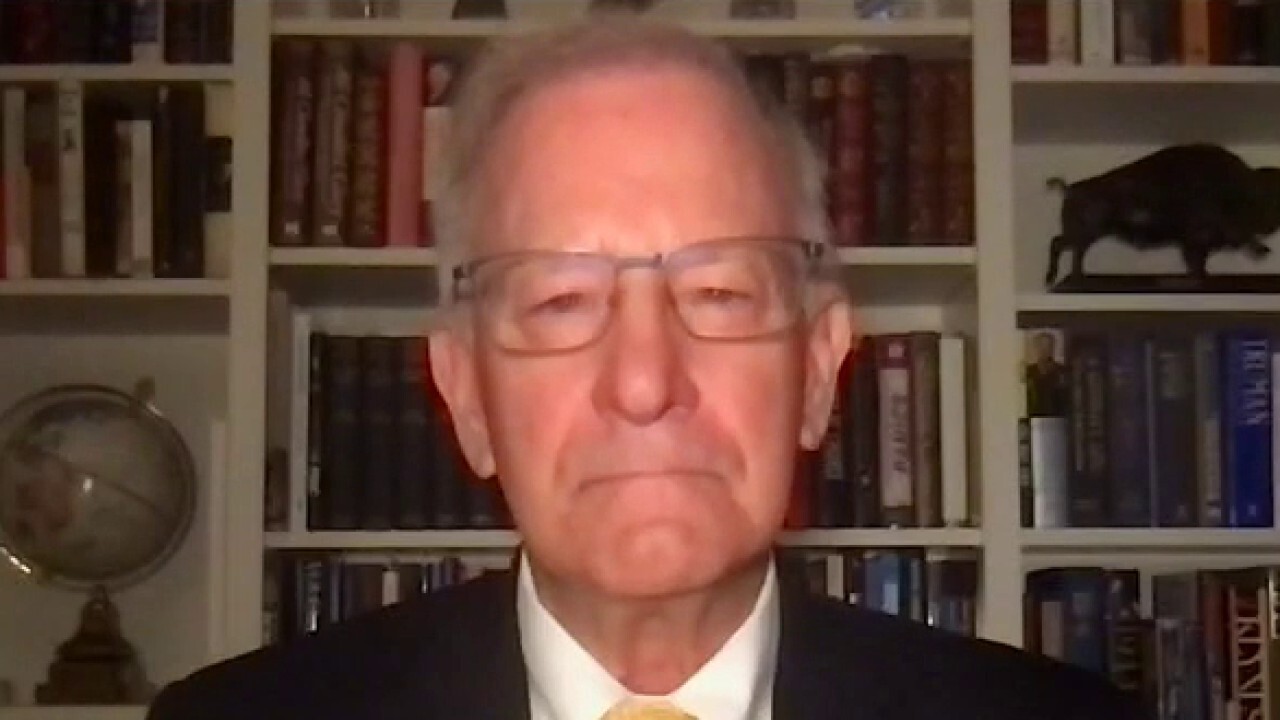

Thomas Hoenig, the former Kansas City Federal Reserve president, weighs in, arguing that a ‘recession is a fair call.’

Thomas Hoenig, who served as president of the Federal Reserve Bank of Kansas City, said on Wednesday that he doesn’t see a "mild soft landing coming our way" as inflation sits at 40-year highs.

He stressed during a ‘Mornings with Maria’ appearance, Wednesday morning, that he doesn’t "know of an easy way" of bringing inflation back down towards the Fed’s goal of 2% or less without causing a recession.

A recession refers to a contraction in gross domestic product (GDP) activity, the broadest measure of goods and services produced across the economy, for two consecutive quarters.

It was revealed in late April that the U.S. economy cooled markedly in the first three months of the year, as snarled supply chains, record-high inflation and labor shortages weighed on growth and slowed the pandemic recovery.

FED RATE HIKE WILL HAVE 'DEVASTATING' IMPACT ON CONSUMERS, FORMER HOME DEPOT CEO WARNS

The Commerce Department said last month, in its second reading of the data, that real GDP decreased at an annual rate of 1.5% in the first quarter of this year, which was slightly higher than the department’s first reading.

Earlier this month it was revealed that inflation remained painfully high in May, with consumer prices hitting a new four-decade high that exacerbated a financial strain for millions of Americans.

The Labor Department said that the consumer price index, a broad measure of the price for everyday goods, including gasoline, groceries and rents, rose 8.6% in May from a year ago. Prices jumped 1% in the one-month period from April. Those figures were both higher than the 8.3% headline figure and 0.7% monthly gain forecast by Refinitiv economists.

Thomas Hoenig, the former Kansas City Federal Reserve president, warns that if the U.S. is not already in a recession, America is certainly “slowing towards” one. (istock / iStock) Speaking on "Mornings with Maria" on Wednesday, Hoenig argued that the Fed was "so far behind the curve." "You cannot implement a priceless policy, which they did with the great financial recession and now with the pandemic, and then it’s not just that you put it in during the crisis, but you maintain that policy well after the crisis, which they did in 2010 – and now they did again in 2021, and not get some really negative consequences," he warned. "And that’s now being shown in both asset and price inflation." Hoenig argued that the Fed’s "mass tightening" will "disrupt the economy further and unavoidably so." "So I don’t see any easy solution," he continued. Last week, the Fed raised its benchmark interest rate by 75-basis points for the first time in nearly three decades as policymakers intensified their fight to cool red-hot inflation. The move puts the key benchmark federal funds rate at a range between 1.50% to 1.75%, the highest since the pandemic began two years ago. SlateStone Wealth chief market strategist Kenny Polcari and Mayflower Advisers managing partner Larry Glazer discuss the Fed’s credibility and the impact of inflation on the markets. Officials also laid out an aggressive path of rate increases for the remainder of the year. New economic projections released after the two-day meeting showed policymakers expect interest rates to hit 3.4% by the end of 2022, which would be the highest level since 2008. The question now is whether the Fed can successfully engineer the elusive soft landing — the sweet spot between tamping down demand to cool inflation without sending the economy into a downturn. Hiking interest rates tends to create higher rates on consumer and business loans, which slows the economy by forcing employers to cut back on spending. Although officials painted a mostly optimistic picture of the economy to date, citing "robust" job gains and low unemployment, projections show that policymakers slashed their outlook for gross domestic product in 2022 to 1.7%, down from 2.8% in March. Officials also expect that unemployment will climb slightly to 3.7% this year and 4.1% by 2024 as they push borrowing costs higher and crush economic demand. WORLD IN EARLY STAGES OF ‘VERY SIGNIFICANT’ RECESSION: ECONOMIST NANCY LAZAR Federal Reserve Chairman Jay Powell rejected the notion that central bankers are trying to induce a recession, arguing that there is "no sign" of a broader slowdown. He sought to assure Americans that higher rates will not trigger a recession and that tightening policy is necessary in order to tame prices, which weighed on households nationwide. Hoenig, a Distinguished Senior Fellow at the Mercatus Center at George Mason University, argued on Wednesday that "if we’re not in a recession, we are certainly slowing towards a recession." Thomas Hoenig, who served as president of the Federal Reserve Bank of Kansas City, explains what will create a ‘great’ reduction of liquidity and borrowing, which he argued will lead to uncertainty. He pointed to the "very significant inflation" and the "world conflict," which affected commodities, including oil and wheat. "And then you have to correct for some very extensive fiscal policies following the pandemic and then monetary policy excess," he continued. Hoenig argued that quantitative tightening, as well as higher interest rates, is "going to create a great deal of reduction in liquidity" and "reduction in borrowing because of the cost increases, which we see in the home market right now and then that creates its own volatility and uncertainty." "So I’d say recession is a fair call," he argued. "Whether we’re in it right now, I don’t know, but I think we’re pretty close." GET FOX BUSINESS ON THE GO BY CLICKING HERE Hoenig provided the insight one day after the National Association of Realtors announced that sales of existing homes in the U.S. slowed for the fourth straight month amid rising mortgage rates and record-high prices. Existing home sales fell 3.4% in May from the month before to a seasonally adjusted annual rate of 5.41 million, according to the association, which noted that sales dropped 8.6% from the same time last year. FOX Business’ Megan Henney contributed to this report. Source: Read Full Article

Markets fear Fed tightening will lead to recession

If US not already in recession, America ‘slowing towards’ one: Former Kansas City Fed president