U.S. Personal Income, Spending Edge Modestly Higher In July

The Commerce Department released a report on Friday showing U.S. personal income increased by much less than expected in the month of July.

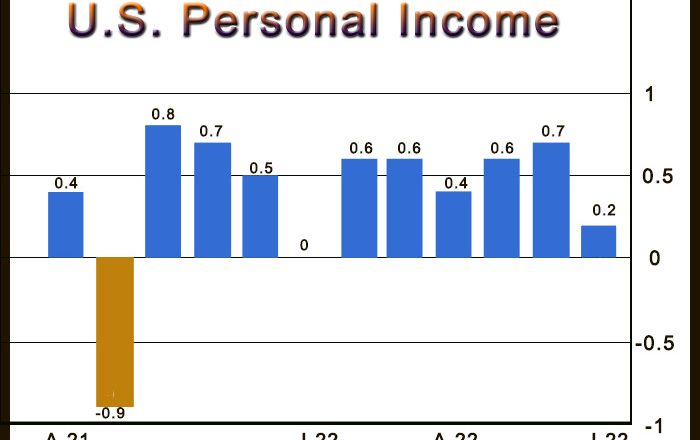

The report showed personal income edged up by 0.2 percent in July after climbing by an upwardly revised 0.7 percent in June.

Economists had expected personal income to rise by 0.6 percent, matching the advance originally reported for the previous month.

The uptick in personal income came as an increase in compensation was partly offset by decreases in proprietors’ income, personal current transfer receipts, and rental income of persons.

Disposable personal income, or personal income less personal current taxes, also crept up by 0.2 percent in July following a 0.7 percent increase in June.

Meanwhile, the Commerce Department said personal spending inched up by 0.1 percent in July after jumping by a downwardly revised 1.0 percent in June.

Personal spending was expected to increase by 0.4 percent compared to the 1.1 percent surge originally reported for the previous month.

Real personal spending, which excludes price changes, edged up by 0.2 percent in July after coming in unchanged in June.

“Consumers spent more on services and discretionary goods but continued to cut back on essentials such as gas and food,” said Lydia Boussour, Lead U.S. Economist at Oxford Economics.

With income and spending both inching higher, personal saving as a percentage of disposable personal income was unchanged at 5.0 percent.

A reading on inflation said to be preferred by the Federal Reserve showed the annual rate of core consumer price growth slowed to 4.6 percent in July from 4.8 percent in June. Economists had expected the pace of growth to slow to 4.7 percent.

Including food and energy prices, the annual rate of consumer price growth slowed to 6.3 percent in July from 6.8 percent in June. The slowdown surprised economist, who had expected the pace of growth to accelerate to 7.4 percent.

“While these readings are encouraging, we expect inflation will remain unacceptably high in coming months and prompt another 125bps of rate hike by the Federal Reserve before year-end,” Boussour said.

Source: Read Full Article