AARP inundated with inflation concerns from seniors

Shopping expert on how consumers can fight ‘shrinkflation’ despite red-hot rates

Smart shopping expert at ‘TrueTrae.com’ Trae Bodge provides expert advice on how consumers can improve their cost efficiency amid hotter-than-expected inflation rates on ‘Mornings with Maria.’

Month after month of sky-high inflation is taking a toll on nearly all Americans, but seniors living on fixed incomes are among the most vulnerable when prices rise – and they are telling the AARP about it.

The advocacy organization for older adults recently held a virtual town hall called "Inflation and You: How to Manage Your Money, Cut Costs and Avoid Panicking," allowing its members to call in with questions on how to weather the current economic storm. It was flooded with callers, with some sharing heartbreaking stories and expressing worries about how they were going to make it.

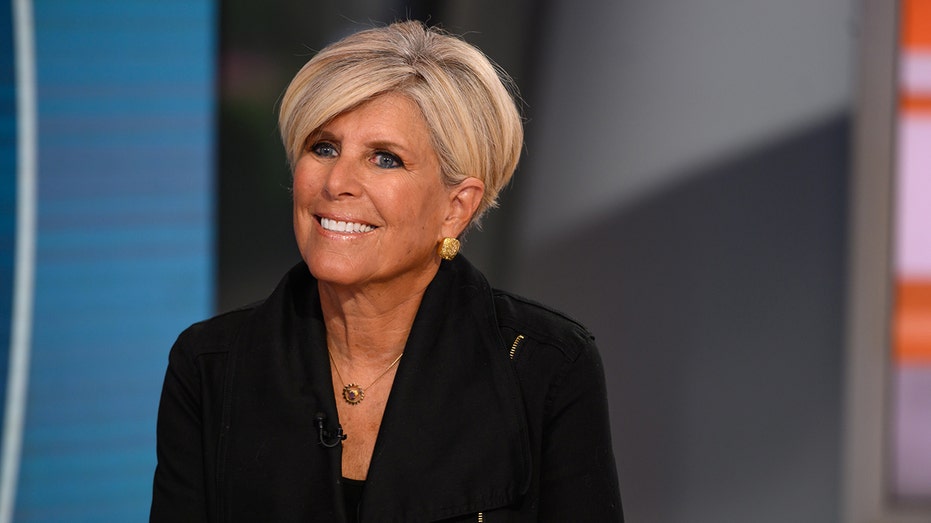

AARP data shows older Americans are increasingly worried about inflation and its impact on their retirements. (Photo Illustration by Rafael Henrique/SOPA Images/LightRocket via Getty Images / Getty Images) "I hear daily from our members about the questions and confusion you're facing because of the impact of COVID and inflation on your personal and your financial lives," AARP CEO Jo Ann Jenkins told the audience. "You know the pandemic has financially impacted people very differently, but right now, everyone is feeling the impact of inflation and supply chain issues." Jenkins noted the soaring costs of groceries and how gas prices soared to record highs over the summer, then pointed to recent AARP data showing 77% of adults over the age of 50 are worried about prices rising higher than their income and that nearly half have cut back on basic expenses like food and gas in the past year. BANK OF AMERICA REPORT: NEARLY TWO-THIRDS OF EMPLOYEES WORRIED ABOUT FINANCES "Now that the prices are rising and the stock market is lower, we're hearing from older adults who are delaying their retirement," Jenkins said, citing another AARP survey from May showing that 42% of adults aged 50 and older have either returned to work in retirement for financial reasons or expect to be forced to do so. Jo Ann Jenkins, CEO, AARP (Photo by Leigh Vogel/Getty Images for Concordia Summit) Financial guru Suze Orman also fielded questions on the call, and heard from one man who was in just that spot. But as the caregiver for his wife who has Parkinson's dementia, returning to the workforce is not so easy. "I need to increase my income stream,' the man said, after noting that he owns his house and vehicle outright and has no debt. "But I have to stay at home to take care of my wife and I just don't know what to do." INVESTOR SENTIMENT ‘UNQUESTIONABLY’ AT WORST LEVEL SINCE 2008 FINANCIAL CRISIS: BOFA Another caller expressed concern over the rising cost of rent, asking if it would ever go down. Someone else said their 401(k) has "been losing money with what the stock market's been doing," and wondered if they should move some of it in case things "get even worse." Questions rolled in from the Facebook comment section, too, but there were too many inquiries for the panel to get to them. Multiple folks said they were considering reverse mortgages. One individual wrote, "I was planning on retiring next year but that seems off the table." Financial guru Suze Orman helped field questions in a recent AARP tele-town hall (Photo by: Nathan Congleton/NBCU Photo Bank/NBCUniversal via Getty Images via Getty Images / Getty Images) But the discussion was not all doom and gloom. Orman pointed out that Social Security payments will likely rise somewhere between 8 or 9% starting next year due to this year's high inflation, and provided investment options for those considering making adjustments. Several viewers expressed their gratitude for the information supplied. GET FOX BUSINESS ON THE GO BY CLICKING HERE Jenkins signaled early on in the call that they knew the topic would be popular. "You know, this is also an election year and we've been talking with older voters about what issues matter most to them," the CEO said. "Again and again they tell us the pocketbook issues are at the top of their concern list." Source: Read Full Article