Silicon Valley Bank Failure Highlights Dangers of Fractional-Reserve Banking – Economics Bitcoin News

After the failure of Silicon Valley Bank (SVB), a great deal of Americans are starting to realize the dangers of fractional-reserve banking. Reports show that SVB suffered a significant bank run after customers attempted to withdraw $42 billion from the bank on Thursday. The following is a look at what fractional-reserve banking is and why the practice can lead to economic instability.

The History and Dangers of Fractional-Reserve Banking in the United States

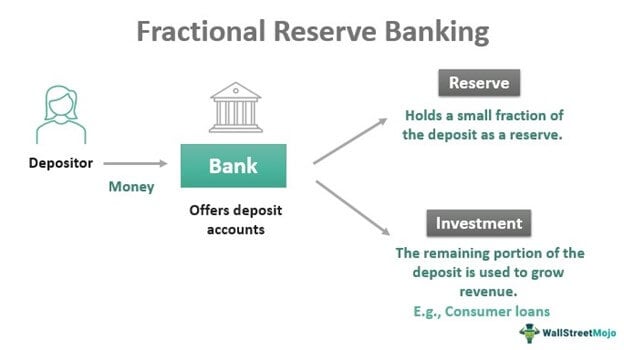

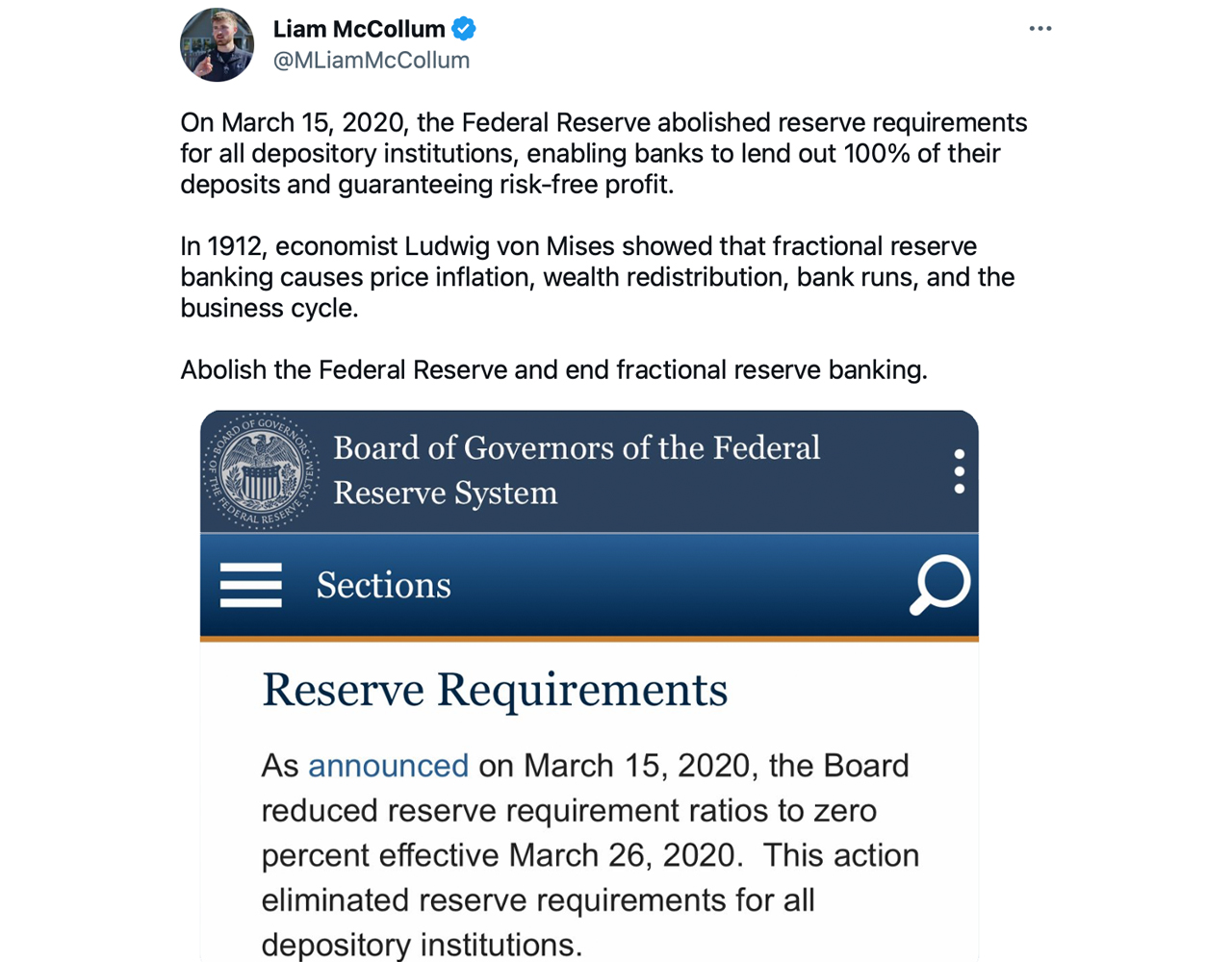

For decades, people have warned about the dangers of fractional-reserve banking, and the recent ordeal of Silicon Valley Bank (SVB) has brought renewed attention to the issue. Essentially, fractional-reserve banking is a system of bank management that only holds a fraction of bank deposits, with the remaining funds invested or loaned out to borrowers. Fractional-reserve banking (FRB) operates in nearly every country worldwide, and in the U.S., it became widely prominent during the 19th century. Prior to this time, banks operated with full reserves, meaning they held 100% of their depositors’ funds in reserve.

However, there is considerable debate on whether fractional lending occurs these days, with some assuming that invested funds and loans are simply printed out of thin air. The argument stems from a Bank of England paper called “Money Creation in the Modern Economy.” It is often used to dispel myths associated with modern banking. Economist Robert Murphy discusses these alleged myths in chapter 12 of his book, “Understanding Money Mechanics.”

The FRB practice spread significantly after the passage of the National Banking Act in 1863, which created America’s banking charter system. In the early 1900s, the fractional-reserve method started to show cracks with the occasional bank failures and financial crises. These became more prominent after World War I, and bank runs, highlighted in the popular movie “It’s a Wonderful Life,” became commonplace at the time. To fix the situation, a cabal of bankers dubbed “The Money Trust” or “House of Morgan” worked with U.S. bureaucrats to create the Federal Reserve System.

After further troubles with fractional reserves, the Great Depression set in, and U.S. President Franklin D. Roosevelt initiated the Banking Act of 1933 to restore trust in the system. The Federal Deposit Insurance Corporation (FDIC) was also created, which provides insurance for depositors holding $250,000 or less in a banking institution. Since then, the practice of fractional-reserve banking continued to grow in popularity in the U.S. throughout the 20th century and remains the dominant form of banking today. Despite its popularity and widespread use, fractional-reserve banking still poses a significant threat to the economy.

The biggest problem with fractional-reserve banking is the threat of a bank run because the banks only hold a fraction of the deposits. If a large number of depositors simultaneously demand their deposits back, the bank may not have enough cash on hand to meet those demands. This, in turn, causes a liquidity crisis because the bank cannot appease depositors and it could be forced to default on its obligations. One bank run can cause panic among other depositors banking at other locations. Major panic could have a ripple effect throughout the entire financial system, leading to economic instability and potentially causing a wider financial crisis.

Electronic Banking and the Speed of Information Can Fuel the Threat of Financial Contagion

In the movie “It’s a Wonderful Life,” the news of insolvency spread through the town like wildfire, but bank run news these days could be a whole lot faster due to several factors related to advances in technology and the speed of information. First, the internet made it easier for information to spread quickly, and news of a bank’s financial instability can be disseminated rapidly through social media, news websites, and other online platforms.

Second, electronic banking has made transactions faster, and people who want to withdraw can do so without physically going to the branch. The speed of online banking can lead to a faster and more widespread run on a bank if depositors perceive that there is a risk of their funds becoming unavailable.

Lastly, and maybe the most important part of today’s differences, is the interconnectedness of the global financial system means that a bank run in one country can quickly spread to other regions. The speed of information, electronic banking, and the connected financial system could very well lead to a much faster and more widespread contagion effect than was possible in the past. While the advances in technology have made banking a lot more efficient and easier, these schemes have increased the potential for financial contagion and the speed at which a bank run can occur.

Deception and ‘Waves of Credit Bubbles With Barely a Fraction in Reserve’

As previously mentioned, many market observers, analysts, and renowned economists have warned about the issues with fractional reserve banking. Even the creator of Bitcoin, Satoshi Nakamoto, wrote about the dangers in the seminal white paper: “The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve,” Nakamoto wrote. This statement highlights the risk associated with fractional reserve banking, where banks lend out more money than they have in reserves.

Murray Rothbard, an Austrian economist and libertarian, was a strong critic of fractional reserve banking. “Fractional reserve banking is inherently fraudulent, and if it were not subsidized and privileged by the government, it could not long exist,” Rothbard once said. The Austrian economist believed that the fractional reserve system relied on deception and that banks created an artificial expansion of credit that could lead to economic booms followed by busts. The Great Recession in 2008 was a reminder of the dangers of fractional reserve banking, and it was the same year that Bitcoin was introduced as an alternative to traditional banking that does not rely on the trustworthiness of centralized institutions.

The problems with SVB have shown that people have a lot to learn about these issues and about fractional banking as a whole. Currently, some Americans are calling on the Fed to bail out Silicon Valley Bank, hoping the federal government will step in to assist. However, even if the Fed saves the day regarding SVB, the dangers of fractional reserve banking still exist, and many are using the SVB failure as an example of why one should not trust the banking system operating in this manner.

Source: Read Full Article