‘Should We Hand Over PSBs To Private Sector’?

‘We have to think of the repercussions if public sector banks are privatised and if they go to foreign hands.’

With the release of the National Council of Applied Economic Research policy paper by NCAER Director-General Poonam Gupta, a member of the Economic Advisory Council to the Prime Minister, and Columbia University Professor and former NITI Aayog vice-chairman Arvind Panagariya, privatisation of public sector banks has once again become a topic of debate in India.

The NCAER paper recommends privatisation of all public sector banks except the State Bank of India.

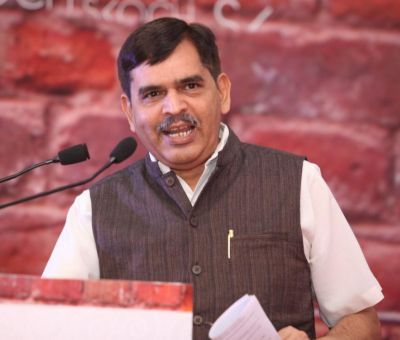

Professor Ashwani Mahajan, the co-convenor of the Swadeshi Jaagran Manch, warns that this is an ill-advised move.

“We have to think of the repercussions if public sector banks are privatised and if they go the foreign hands,” Professor Mahajan, below, left, tells Rediff.com‘s Shobha Warrier in the first of a two-part interview.

The NCAER policy paper says all public sector banks should be privatised except the SBI as part of banking sector reforms.

Does that mean we have to put an end to all public sector undertakings and hand them over to the private sector?

Is that what reform is all about?

If you look at the authors of this report, Arvind Panagariya and Poonam Gupta, their opinion on privatisation is well known. So, there is nothing surprising about the report.

The government also is talking about privatising the banking sector…

We see that the government was following the path of consolidation of banks to make them bigger by merging some banks.

The problem started with the NPAs (non performing assets) in public sector banks which affected the stability of many public sector banks.

So, those banks that incurred losses were made to merge with profitable banks.

The Swadeshi Jaagran Manch had no objection to these mergers because we knew making four banks into one will not make any difference except a restructuring of the balance sheet.

In fact, we are not against, or for consolidation of PSBs as long as the government remains the owner of the banks.

Now, regarding the clamour for privatising public sector banks. There are a set of economists who are in favour of privatisation right from the beginning.

When 14 banks were nationalised in 1969, there was also a thinking that the private sector would manage banks better and that if you took everything under the public sector, private initiatives in the banking sector would be affected.

At that time, the dominant thought was socialistic and that everything should be in the public sector.

But today, you have to think afresh about the idea of privatisation of banks.

There are many schools of thought on this.

The question is, should we hand over the public sector banks to the private sector?

When Modiji took over as the prime minister in 2014, one of the first initiatives was inclusive banking by starting Jan Dhan accounts.

Is there not a contradiction in starting Jan Dhan accounts for inclusive banking where the minimum balance is zero, and privatising public sector banks?

In Jan Dhan accounts, the profitability was not muc,h but the initiative was to achieve inclusion of all population in the banking sector.

Today, except for a very small percentage, majority of the population in India has a bank account and they are linked to Aadhar and their mobiles.

This has transformed and revolutionised the whole banking and fiscal system.

Yes, only public sector banks can do social and inclusive banking and also the implementation of government schemes.

The question I would like to ask is: If public sector banks are privatised, will the government be able to do this?

Private banks constitute 35%-37% of the total deposits and lending. They open only 10% of the accounts while 90% of the accounts were opened by public sector banks.

Though the government has shown its intent in changing the banking law in such a way that the shares of public sector banks should be divested bringing the government’s ownership to zero from 51%, it has not yet done so.

Many sessions of Parliament have passed, but they are yet to bring in the Banking Law (Amendment) Bill.

That’s because there are two schools of thought: One for privatisation and another for not privatisation.

Where does the Swadeshi Jaagran Manch stand?

Our stand is, we may not mind if the shares are held by the government or by the general public.

But this proposed privatisation is not going to be done by issuing an IPO.

The proposal is to sell them. Now the question is, if it is going to be handed over to the private sector, who will buy these banks?

Already, the promoters of all the private sector banks have been asked to shell their equity and their percentage is declining.

Now, who is owning these private sector banks? You will see that FIIs own 25%-45% of the total shares in all the major private banks.

In some cases, the foreign ownership has even gone up to 80% and above.

That means the promoters of the private sector banks do not have the capacity to buy such huge public sector banks

The private sector banks were owned by the corporates, and they were taken away from them because there shouldn’t be crony capitalism.

You spoke of foreigners owning even up to 80% of some private banks. Does that not remind us of how the economies of some Asian countries collapsed due to the financial crisis of 1997?

That’s exactly what I am saying. We have to think of the repercussions if public sector banks are privatised and if they go to foreign hands.

What is going to happen in the name of privatisation is not just privatisation.

We are pushing our public sector banks to foreign hands.

This is something we should be thinking about.

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article