Stalling tough decisions on housing has left a mess of our own making

Save articles for later

Add articles to your saved list and come back to them any time.

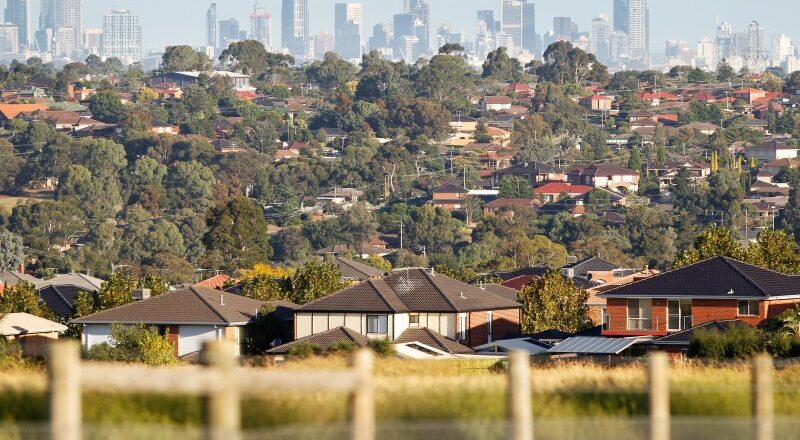

Melbourne must now make a choice: keep sprawling or consolidate.

As Infrastructure Victoria suggests in a well-researched and somewhat alarming report released on Friday, if Melbourne continues to expand its fringe at the current pace, it will face enormous social and economic costs.

Experts and the government agree we can’t keep expanding outwards.Credit: Alamy

Our city will become even more choked with cars, and our citizens will increasingly be denied access to the job opportunities, infrastructure and social services needed to protect Melbourne’s coveted liveability.

What is to be done? The government’s long-standing target is to ensure that seven of every 10 new homes are built in established parts of Melbourne. That will require almost 1 million extra homes in existing suburbs by 2051.

On this, it is badly failing. Department of Planning data shows that in 2021 just 44 per cent of new homes in Melbourne were built in established suburbs, down from 67 per cent in 2013.

The state government’s housing statement, touted as one of the biggest planning overhauls in Victoria’s history, was meant to provide a road map to reverse this trend, with the promise of 80,000 houses a year for a decade and more affordable housing in established suburbs.

Among other things, it included plans to rezone some surplus government land, demolish and redevelop Melbourne’s 44 public housing towers over three decades, and streamline planning processes for housing projects if they include 10 per cent “affordable housing”. The concept of affordable housing, although mentioned frequently throughout, was not clearly defined.

It was a start. Yet in the short-to-medium term, it’s hard to see how these policies alone will have anywhere near enough clout to fix the looming demographic, economic and planning challenges confronting the state.

As Infrastructure Victoria makes clear in its report, several of Victoria’s key planning, housing and tax policy settings remain detrimental to the government’s aspiration to consolidate the city and boost affordability.

Victoria’s First Home Owner Grant scheme, the report notes, “is a subsidy that actively encourages urban sprawl”.

Then-premier Daniel Andrews released his housing policy last month and signed an “affordability pledge” with representatives from the property sector.Credit: Elke Meitzel

Far from boosting housing affordability, the scheme, which offers $10,000 payments for newly built houses worth up to $750,000, has rather served to line the pockets of developers. If anything, it has fuelled price growth.

Scrapping the grant would save an average of $157 million a year and cash could be used for better-targeted measures to boost homeownership in existing suburbs, such as beefed-up shared equity schemes and stamp duty concessions.

Likewise, the state government has so far also avoided an overhaul of Victoria’s complex system of developer levies used to help pay for roads, schools and hospitals on Melbourne’s fringes.

Infrastructure Victoria describes the current rules as “convoluted”, calling for a new, clear, efficient and transparent infrastructure contribution charge applying across the state – not just the fringes – to help influence the location of new development.

In the same vein, it has called on the state government to abolish stamp duty and replace it with a broad-based land tax that would not discourage people from moving, providing incentives for denser residential development.

Despite its amped-up rhetoric about tackling housing affordability, the state government has so far stalled any tough decisions.

If the Allan government is serious about tackling affordability and maintaining Melbourne’s liveability as a much larger city, it must now confront some tricky policy reforms. Time to get cracking.

The Morning Edition newsletter is our guide to the day’s most important and interesting stories, analysis and insights. Sign up here.

Most Viewed in National

From our partners

Source: Read Full Article