Real Vision CEO Predicts Institutional Investment Boom in Crypto

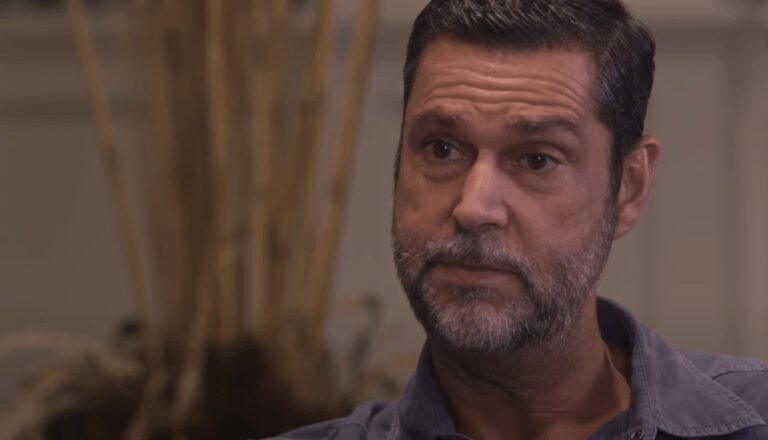

In an enlightening episode of Binance VIP Voices, Raoul Pal, CEO and co-founder of Real Vision Group & Global Macro Investor, shared his expertise on the burgeoning world of institutional crypto trading. With over three decades in finance and a strong footing in digital assets since 2012, Pal’s journey includes tenure at Goldman Sachs and managing a significant hedge fund for GLG Partners.

Traditional vs. Crypto Trading Dynamics

Pal highlighted the similarities between all markets, noting the heightened volatility in digital assets due to their early growth stage. He described this as a double-edged sword, offering potentially high returns but accompanied by considerable risk, making them both a lucrative and challenging addition to investment portfolios.

The Evolution of Institutional Crypto Strategies

Looking at the institutional adoption of cryptocurrencies in 2023 and 2024, Pal observed an increasing interest in crypto investments. Pal noted that institutions have gradually moved from initial exploratory investments to more substantial involvements, including tokenization projects and structured product development. He emphasized the growing interest in yield-bearing digital assets like Ethereum, marking a significant shift in institutional strategy towards crypto.

Institutional Influence on Crypto Markets

Pal forecasted a substantial influx of institutional investors in the next business cycle, potentially elevating the crypto market to a valuation exceeding 10 trillion. He anticipated that the growth would be driven by institutions integrating crypto products into their networks, facilitating broader capital inflow and a shift from individual to aggregated investment mechanisms.

Financial Institutions’ Post-2024 Strategies

Beyond 2024, Pal envisaged a transformative change in financial institutions’ approaches, with an increased focus on blockchain for varied applications like stablecoins, foreign exchange, and securities. He cited examples from major players like Goldman Sachs and Fidelity, highlighting the industry-wide momentum towards embracing blockchain technology and digital assets.

Digital Assets in Institutional Portfolios

Finally, Pal advised asset managers new to crypto to view digital assets, particularly Bitcoin, as a portfolio stabilizer despite its volatility. He suggested that traditional asset management firms should rely on established financial institutions’ asset allocation models to integrate digital assets effectively into their portfolios, highlighting the need for understanding where these assets fit within traditional investment strategies.

Source: Read Full Article