Cardano Community Mount Offensive Against the U.S. SEC For Naming ADA a Security

Cardano (ADA) and the broader cryptocurrency market faced a significant setback as the U.S. Securities and Exchange Commission (SEC) targeted Binance and its CEO, Changpeng Zhao, with a lawsuit. The regulatory action contributed to a market-wide price decline, impacting several crypto assets, including Cardano, which dropped over 5% hours after the announcement.

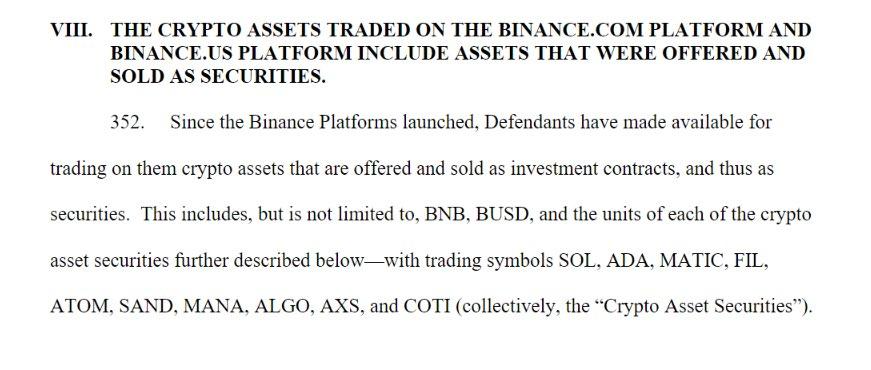

The SEC filed a complaint in the District of Columbia, alleging that Binance has been offering “unregistered securities” since its inception. In the complaint, the SEC specifically mentioned several cryptocurrencies that are claimed to fall into this category, including Cardano (ADA), Solana (SOL), Polygon (MATIC), Algorand (ALGO), Filecoin (FIL), and others.

In its filing, the SEC provided an overview of Cardano’s background, expressing concerns about its level of decentralization. In support of its argument, the SEC contended that the Cardano Foundation handles legal custody and brand ownership; IOHK, an engineering firm led by Charles Hoskinson and responsible for blockchain design and maintenance; and Emurgo possessed a substantial portion of ADA’s overall supply.

“These three entities collectively received 5.2 billion ADA following the initial mining of ADA or approximately 16.7% of the initial token supply of 31.1 billion ADA,” read the complaint.

The regulator asserted that these companies sold the token to finance different aspects of their projects, such as development, marketing, and business operations.

In response to the SEC’s classification, members of the Cardano community took to Twitter to voice their support and counter the allegations. Dr Shweta, a proponent of Ripple, emphasized that ADA cannot be considered a security citing the Howey Test, which states that cryptocurrencies meeting certain criteria can be classified as securities.

According to his analysis, Cardano does not meet those criteria, as it was not offered to U.S. investors during its initial coin offering (ICO). He thus argued that it is not a security token, stablecoin, or decentralized finance (DeFi) token.

Another Cardano adherent, Chris O, criticized the SEC’s argument, stating that the complaint overlooked crucial facts. Chris O pointed out that the ADA ICO occurred in Japan and was not accessible to U.S. investors. Moreover, he highlighted the omission of the thousands of stake pool operators who actively participate in running the Cardano protocol. The pundit also expressed confidence in Cardano’s decentralization, emphasizing that it would be the ultimate shield against such claims.

That said, as the legal battle between the SEC and Binance unfolds, Cardano proponents remain determined to defend their platform’s reputation and decentralized nature. It thus remains to be seen how this offensive against the SEC’s classification will shape the future of Cardano and its standing within the crypto market.

At press time on Tuesday, ADA was trading at $0.356, up 1.3% in the past 24 hours. Other cryptos had also recovered from what most players call FUD by the SEC, with Bitcoin and Ethereum up over 3% over the same duration.

Source: Read Full Article