Bitcoin Unprecedented Liquidity And Rate Reversal: A Perfect Storm For Market Correction?

Despite Bitcoin’s recent recovery to the key level of $26,100, signaling a crucial point for its future gains and preventing further decline, there are worrisome signals that could raise concerns for Bitcoin bulls in the short term.

The combination of factors presents a potential perfect storm for a market correction.

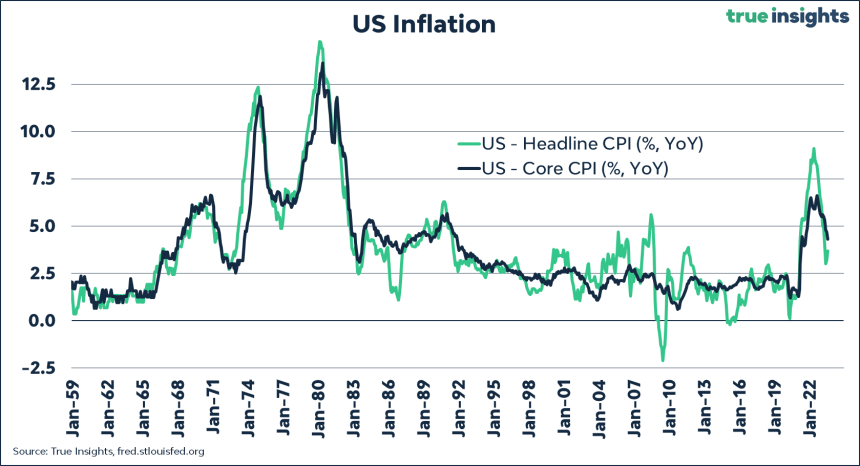

One contributing piece is the higher-than-expected US August headline inflation, coming in at 3.7% up from the previous month’s 3.2%. Although not a game-changer, it implies that the odds of another rate hike are marginally up, now standing at 53%. Jeroen Blokland, a multi-asset investor, highlights this development.

Additionally, Bloomberg’s senior macro strategist, Mike McGlone, suggests that Bitcoin may be leading a downward trend. McGlone emphasizes that Bitcoin is an “exceptionally liquid” asset that has experienced significant appreciation without being tied to specific projects or liabilities.

However, since it emerged during a period of historically low-interest rates, its position as a potential frontrunner for a market reversion is noteworthy.

US Inflation Data And Rising Interest Rates Pose Challenges For Bitcoin Bull Run

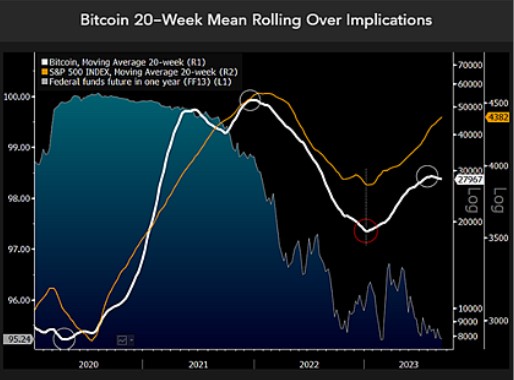

One key indicator highlighted by McGlone is the rollover of Bitcoin’s 20-week moving average (MA), which has implications for all risk assets.

Being one of the best-performing assets in history, Bitcoin’s reversion lower is a significant observation. McGlone’s analysis reveals that federal funds futures for the next year hover above 5%, indicating limited expectations for liquidity from the Federal Reserve (Fed).

A similar pattern was observed in Bitcoin’s mean reversion at the beginning of 2022 when futures began pricing for the current tightening cycle.

As the lower bound of the federal funds rate rapidly rises from zero to 5.2% and is expected to continue increasing, significant pressure on all risk assets, including Bitcoin, may ensue.

McGlone also highlights the historical relationship between Bitcoin and the broader market. Following the liquidity injection resulting from the shift to zero interest rates in early 2020, Bitcoin’s 20-week moving average reached its bottom before the S&P 500 experienced a similar trend in the third quarter of that year.

Mike McGlone’s analysis raises concerns about Bitcoin’s future performance amid changing interest rate dynamics and the potential impact on all risk assets. As Bitcoin’s 20-week moving average shows signs of rolling over, investors and market participants will closely monitor its price trajectory and its ability to withstand the pressures of rising interest rates.

BTC’s Battle With Resistance, Will It Break Through Or Face A Seven-Month Low?

At the time of writing, the leading cryptocurrency in the market, Bitcoin (BTC), is facing a challenge in surpassing the resistance wall at $26,400, as highlighted by NewsBTC.

Over the past 24 hours, BTC has managed to gain a modest 0.3%, while the most significant gains in the last 30 days have occurred within the seven-day timeframe, with a modest surge of 1.9%.

Should BTC succeed in surpassing its immediate resistance, it will encounter the formidable 200-day and 50-day moving averages (MA) at levels of $27,000 and $27,100, respectively. These levels pose significant hurdles for the cryptocurrency’s prospects and potential future gains.

Conversely, if BTC experiences an extended decline and relinquishes its current modest gains, Bitcoin bulls must closely monitor the crucial threshold at the $25,150 level.

A breach of this level could potentially drive BTC down to a seven-month low of $22,000, jeopardizing the cryptocurrency’s bull run and the gains achieved since the beginning of the year.

Source: Read Full Article