Will Harmony's INTUNE Trial Data Strike A Chord?

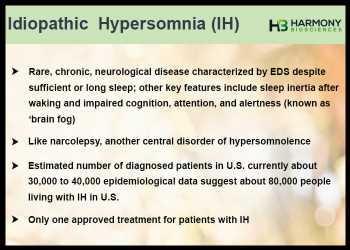

Idiopathic Hypersomnia, or IH, is a rare and chronic neurological disease that is characterized by excessive daytime sleepiness despite sufficient or even long sleep time. Sleep inertia (prolonged difficulty waking up from sleep) and ‘brain fog’ (impaired cognition, attention, and alertness) are also accompanied by excessive daytime sleepiness in people living with IH.

Although there are a couple of off-label treatments, Xywav is the first and only FDA-approved treatment for idiopathic hypersomnia. The number of patients diagnosed with IH in the U.S. ranges from 30,000 to 40,000, with an equal number of patients potentially remaining undiagnosed.

The stock we are bringing to your attention today is Harmony Biosciences Holdings Inc. (HRMY), which is testing its flagship drug Wakix for idiopathic hypersomnia.

Wakix is under a phase III trial for idiopathic hypersomnia, dubbed INTUNE. This study, initiated in April 2022, is fully enrolled with about 200 IH patients across the U.S.

The company expects to report topline data from the INTUNE study in the fourth quarter of 2023.

According to reports, the estimated total market opportunity for idiopathic hypersomnia is projected to reach over $2 billion by 2030.

Wakix, which contains the active ingredient Pitolisant, is approved by the FDA for the treatment of excessive daytime sleepiness or cataplexy in adult patients with narcolepsy.

The drug is also being explored in the indication of Prader-Willi Syndrome.

In a phase II proof-of-concept study of Wakix for the treatment of excessive daytime sleepiness (EDS) in people with Prader-Willi syndrome, both the high- and low-dose doses demonstrated clinically meaningful improvements.

Prader-Willi syndrome (PWS) is an orphan/rare, genetic neurological disorder characterized by two main symptoms namely excessive daytime sleepiness (EDS) and hyperphagia (extreme hunger).

The company plans to initiate a phase III study of Wakix in patients with PWS in the fourth quarter of 2023.

Another potential indication of Wakix is Myotonic Dystrophy, a rare, genetic multi-system disease for which there is no approved drug.

A phase II trial evaluating the safety and efficacy of Wakix for excessive daytime sleepiness (EDS) and other non-muscular symptoms in adult patients with type 1 myotonic dystrophy is ongoing.

The company plans to report topline data from the Myotonic Dystrophy trial in the fourth quarter of 2023.

Since its launch in November 2019, Wakix’ net product revenue has demonstrated a steady and notable rise over subsequent years, as evidenced by the following figures – starting at $5.99 million in 2019, it surged to $159.7 million in 2020, further climbing to $305.4 million in 2021, and achieving a significant milestone of $437.9 million last year.

This consistent growth reflects the drug’s growing popularity and success in the market and the company is confident in Wakix’ potential to become a $1 billion plus opportunity in narcolepsy alone.

Q2 Scorecard

For the second quarter ended June 30, 2023, the net product revenue of Wakix was $134 million compared to $107 million in the year-ago quarter, an increase of 25%.

On a non-GAAP basis, the company’s net income was $45.9 million or $0.76 per share for the second quarter of 2023, up from $34.7 million or $0.57 per share in the year-ago quarter.

Zynerba Deal

In a bid to expand its pipeline and diversify its portfolio to drive long-term growth, Harmony Biosciences agreed to acquire Zynerba Pharmaceuticals, Inc. on Aug.14, 2023.

Zynerba’s lead asset is Zygel, which is currently being evaluated in a pivotal phase III clinical trial for patients living with Fragile X syndrome (FXS), dubbed RECONNECT Trial.

Cash position

Harmony ended June 30, 2023, with cash, cash equivalents and investment securities of $429.6 million.

The company’s shares began trading on the Nasdaq Global Market under the ticker symbol “HRMY” on August 19, 2020, priced at $24 per share.

In the last 1 year, the stock has traded in a range of $29.81 to $62.08. HRMY closed Friday’s trading at $32.52, up 1.98%.

Source: Read Full Article