‘Whatever the government says, take with ton of salt!’

‘The prospects for both India and the global economy is that we are headed towards a very difficult time.’

‘I see very uncertain at least 8-10 months for both India and the rest of the world.’

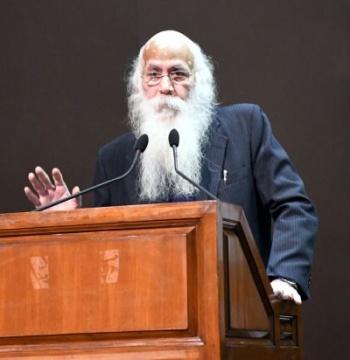

“The whole effort of the government is to paint a rosy picture rather than present the actual picture so as to prevent a further fall in the financial markets,” Professor Arun Kumar, retired professor of economics, JNU, and author of many books on the economy, tells Shobha Warrier/Rediff.com in the concluding part of a two-part interview.

- Part I: ‘Our rate of growth will fall further’

Forex reserves have already dwindled by $8.02 billion…

As time goes, it will fall further because exporters who earn foreign exchange, will delay bringing it back to India.

They will wait for the rupee to fall further so that they will make more money.

At the same time, importers will start importing quickly since it will become more expensive later. This will increase foreign exchange outflow.

Don’t you think interest rates going up in the US will make foreign investors to take money back home?

That was happening from October-November 2021 onwards.

Now that the US has increased interest rates, the RBI is also forced to increase interest rates.

Otherwise the differential in interest rates will decrease, and more of capital will be pulled out of India.

Interest rates are going up not only in the US, but also in Europe.

Yes, the global economy is headed towards recession.

Do you think the government is once again in denial mode?

The whole effort of the government is to paint a rosy picture rather than present the actual picture so as to prevent a further fall in the financial markets.

So, we have to read whatever the government says with a pinch of salt; or a ton of salt!

Another thing is, they are all the time comparing the situation with that during the UPA period or in other parts of the world.

The point is, how does that matter to the people today? People are bothered about how they are impacted today rather than what happened 10 years back or what is happening in other parts of the world. India is unlike the USA or UK.

The finance minister said an increase in the GST on certain food items will not affect the poor… How can that be?

When you look at inflation, it affects the poor, the middle class and the rich differently.

The consumption pattern is different for people belonging to different classes.

That’s why earlier, you had different consumer price indices for agricultural labour, blue collar workers and the white collar workers.

Now, we have combined them all into one. So, it doesn’t reflect what’s happening to the rich or the poor.

It’s a bit of misnomer to say that people are not really affected by inflation or the GST price hike.

The rich have savings and they can use them ,but the poor have no savings and have to cut their consumption of say on their children’s milk or school books.

The finance minister said it was a good time for the economy as the government has got Rs 1.5 lakh crores from the 5G auction and the GST collection for July rose by 28%…

As I said earlier, the government is trying to paint a rosy picture.

The fact is, the unorganised sector that constitute 94% of the work force is declining.

When you say that GST collection is rising, who is paying the GST? It is the organised sector.

So, they are doing well. Also imports and inflation are boosting the GST collections.

That is supported by the fact that the corporate tax collection and the income tax collection are also rising fast. Who pays the corporate tax? Not the unorganised sector.

Who pays the income tax? Like the prime minister said, only 1.5 crore (15 million) people are effectively paying income tax. They are also, from the organised sector and the well-off sections.

Therefore, the finance minister’s data only reflects the rise in the organised sector which is growing at the expense of the unorganised sector.

You mean, that is the real picture of the Indian economy?

Yes. What the officials do is showing a spin on the data. They are not taking into account the unorganised sector.

So, they have made the unorganised sector invisible in data and policy.

In the 2008 global recession, India was not that affected. Today, do you think India will not be spared as it has become more and more linked to the global economy?

In 2008, the Government of India pumped in a lot of money — about Rs 2 lakh crore-Rs 3 lakh crore — into the rural economy through the rural employment guarantee scheme, mid-day meal scheme, the loan waiver scheme, etc.

The loan waiver scheme itself was around Rs 75,000 crores. So, the rural demand did not fall then.

This time, our fiscal situation is much worse.

Our fiscal deficit, counting the states, is around 10%-11%. Because our fiscal deficit is already very high, the government is not giving much to the poor people.

In 2008, the government cut indirect taxes to raise demand. But today, they are rather raising indirect taxes. So, prices are going up and demand is impacted.

About the rupee falling against the dollar, the finance minister said, the rupee was better placed than other currencies and not collapsing … Is the argument valid?

Because of the severe impact of the Russia-Ukraine war on Europe, the euro and pound are falling sharply. Their central banks are not supporting the currencies from falling.

On the other hand, the rupee has not fallen that much because the RBI is supporting it.

Further, Russia is giving oil with a 30% discount on the pre-war price.

So, you cannot compare India’s situation with Europe. Hence, the argument is not valid.

What is the realistic future you see for the Indian and global economy in the coming months?

There is a lot of uncertainty in the economy, so, it is difficult to predict.

The situation in China is not good as they are imposing lockdowns from time to time due to their zero-covid policy.

Since they are the global manufacturing hub, there are supply bottlenecks globally.

In India, a lot of small businesses have closed down. So, we have supply bottlenecks here.

Nobody knows when the Ukraine war will end, and whether the sanctions against Russia will be lifted. So, supply bottlenecks due to these factors will continue.

All these factors are creating a lot of uncertainty.

So, the chances are that demand will decline, and we are heading towards a global recession.

When a global recession happens, the Indian economy also will go into a recession. It cannot escape that.

The Russia-Ukraine war is actually a proxy war between two superpowers; Russia on one side and Ukraine supported by the USA, Europe etc on the other side.

By prolonging the Ukraine war, the other side feels they can weaken Russia.

Thus there will be a long-term impact. China and Russia will go together. Along with Iran and some other countries, they will work as a bloc.

So, there will be two blocs. There will be pressure on India to join these blocs.

It means the Cold War again; one that will not end very soon. This will impact trade and finance globally.

So, I expect the recession to continue for some time.

This is not going to be a short term recession. Now the Bank of England has also said this.

The prospects for both India and the global economy is that we are headed towards a very difficult time.

I see very uncertain at least 8-10 months for both India and the rest of the world.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article