$GMX: A Closer Look at the Avalanche and Arbitrum Powered Decentralized Exchange GMX

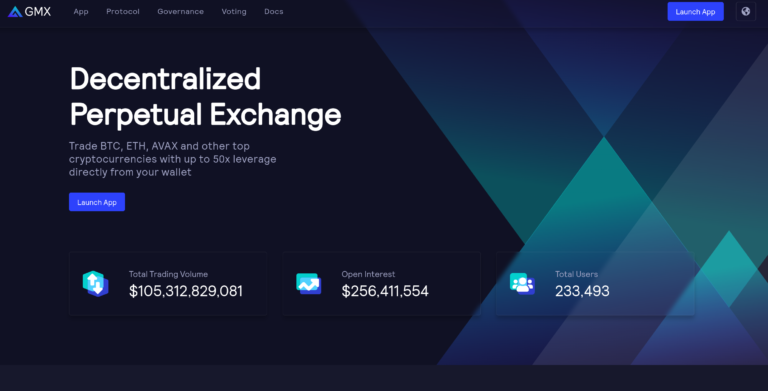

This article looks at $GMX — the governance and utility token of GMX, a popular decentralized exchange that runs on Arbitrum and Avalanche — and some notable names that have been accumulating it lately.

Here is what Binance Academy says about this DEX as well as its utility and governance token:

“GMX is a decentralized spot and perpetual exchange that enables users to trade BTC, ETH and other popular cryptocurrencies directly from their crypto wallets… GMX aims to provide a better trading experience with low swap fees and zero-price impact trades. The trading happens through its native multi-asset pool, GLP, which earns fees for liquidity providers. In addition, GMX uses Chainlink Oracles for dynamic pricing to aggregate prices from other high-volume exchanges.

“GMX first launched on the Arbitrum One blockchain when the network went live in September 2021. Arbitrum is an Ethereum layer-2 Rollup, a solution designed to boost the speed and scalability of Ethereum smart contracts. Later, in January 2022, the deployment of GMX continued on Avalanche, which is also a high-speed EVM-compatible blockchain… The GMX token is a utility and governance token. Token holders can use it to vote on proposals to help decide the exchange’s future direction.

“The token holders who stake their GMX also get three other rewards, which the protocol uses to reward users. Firstly, 30% of all generated protocol fees are distributed to GMX stakers. These fees are collected from market making, swap fees, and leverage trading, and are paid in ETH or AVAX.

“Secondly, the stakers earn escrowed GMX (esGMX) tokens. These esGMX tokens can be either staked for rewards as well, or vested. The tokens get converted back into GMX over 12 months when a user vests them. Therefore, esGMX emissions are a form of locked staking that prevents inflation and people from immediately selling their GMX.

“Lastly, stakers earn Multiplier Points that boost their yield and reward long-term holders without contributing to token inflation. These dual incentives stimulate commitment to GMX and further the platform’s decentralized ownership.

“The GMX token has a maximum supply of 13.25 million, with 8.2 million circulating. More than 83% of the circulating tokens are currently staked.“

Currently (as of 9:05 a.m. UTC on 22 February 2023), $GMX is trading around $72.60, and it has a market cap of around $617 million, making it the 77th most valuable cryptoasset by market cap. In the year-to-date period, $GMX is up 78.44%.

On Tuesday (21 February 2023), blockchain activity tracker “Lookonchain” said that it had noticed that Amber Group, which acts as “liquidity providers, miners, and validators on 70+ exchanges, applications, and networks”, and crypto-focused asset management firm Arca are accumulating $GMX:

It went on to say:

On 9 December 2022, BitMEX Co-Founder Arthur Hayes published a blog post in which he called $GMX a “super-powered” asset:

“My ideal crypto asset must have beta to Bitcoin, and to a lesser extent, Ether. These are the reserve assets of crypto. If they are rising, my asset should rise by at least the same amount – this is called crypto beta. This asset must produce revenue that I can claim as a token holder. And this yield must be much greater than the 5% I can earn buying six or 12-month treasury bills. I have a few super-powered assets such as GMX and LOOKS in my portfolio.“

Source: Read Full Article