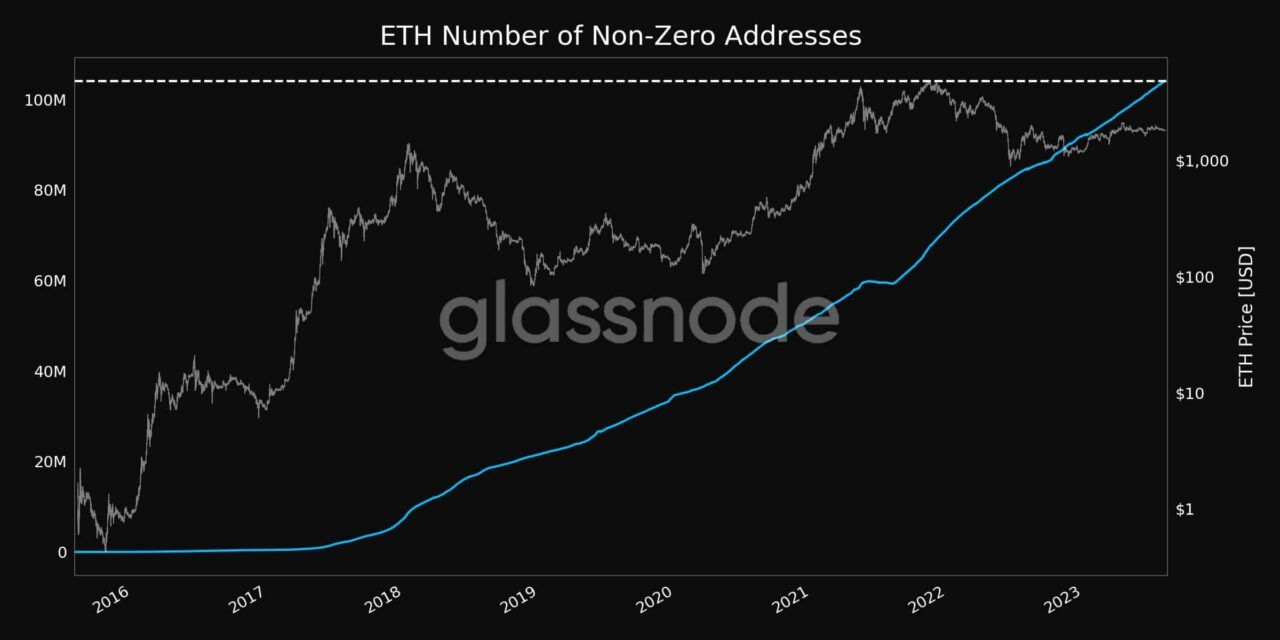

Ethereum ($ETH) Addresses With a Balance Hit New Record High Above 100 Million

The number of addresses on the Ethereum ($ETH) network with a balance has recently hit a new all-time high of 104,076,868, meaning that these addresses now hold at least one wei, the smallest unit of ETH, in a figure that represents a significant rise from figures in previous years.

The data comes from cryptocurrency analytics firm Glassnode and shows how Ethereum’s adoption has been growing, partly over the rise of the decentralized finance (DeFi) space and its ecosystem.

In comparison, Bitcoin’s non-zero addresses, meaning Bitcoin addresses with at least one satoshi in them, have recently surged to around 48 million, less than half of the Ethereum addresses with a balance.

While the Ether cryptocurrency recently stabilized around the $1,830 mark, there has been an unmistakable uptick in the number of Ethereum non-zero addresses in recent times. These addresses numbered around 20 million in 2019, escalating to nearly 50 million by early 2021, right on the cusp of a bullish wave which took Ethereum to an unprecedented price of almost $4,900, according to market data..

Glassnode’s data has also shown that over 4.3 million ETH, of the total circulating 120 million, last saw activity between seven and ten years ago. This prolonged dormancy is indicative of long-term faith and possibly strategic holding patterns by investors.

Taking a broader view on the cryptocurrency sphere, Bitcoin, the pioneering digital currency, isn’t lagging in terms of dormant holdings either. Glassnode’s latest data reveals that 5.67 million BTC have remained untouched since at least 2017.

Given that the total circulating Bitcoin supply stands at 19.45 million, this indicates that close to 30% of the currency remains in a long-term holding phase.

Ethereum has notably recently seen PayPal, a dominant force in the digital payments realm, unveil it’s launching a stablecoin called Payal USD (PYUSD) on top of its network, in a testament to PayPal’s ambition to further penetrate the burgeoning world of Web3 and digital-centric payments.

Featured image via Unsplash.

Source: Read Full Article